Go paper-free

Amend paper-free preferences for your statements and correspondence.

That's a very good question. Weigh up your saving and investment options to find a combination that works for you.

Saving and investing can work well together, helping you to achieve your financial goals.

Only you can decide whether it’s best to save, invest, or do a bit of both. The following tools might help you consider your options.

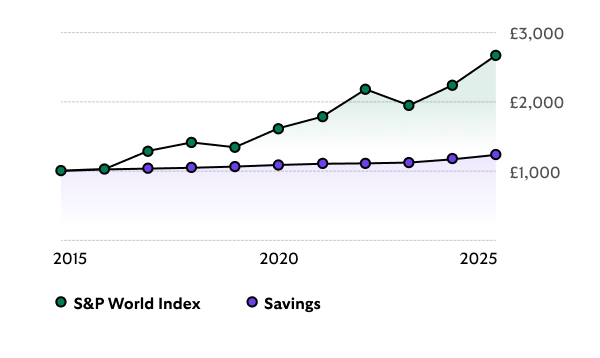

While future performance isn’t guaranteed, it’s still interesting to compare cash savings performance with investment growth over a 10-year period.

Savings - MoneyFacts, 12m Fixed Non ISA rates, January 2025.

Investments - S&P Dow Jones Indices, S&P World Index (GBP). Excludes fees and does not include any dividends or reinvestment.

These figures refer to the past and past performance is not a reliable indicator of future performance. See a data breakdown of the performance in the table here. See a data breakdown.

You can save or invest as much as you want. But the Government does set limits on how much interest you can earn before you have to pay tax.

The interest on cash ISAs is free from UK tax. This means that, while some of your interest in other savings accounts may be subject to income tax, you don't pay any UK income tax on cash ISA interest.

You don’t pay any extra UK personal income tax and UK capital gains tax, where applicable, on any potential money you earn from a stocks and shares ISA, innovative finance ISA or Lifetime ISA.

Once you’ve reached your ISA allowance, you can put any other money into a general savings or investment account.

What is a stocks and shares ISA?

Inflation can affect your savings. For example, if you put away a sum of money last year and inflation increases, it may not hold the same value as it did before.

The inflation rate can also have an affect on your investments and any potential returns. The real rate of return measures this. This is your annual growth percentage adjusted for inflation.

Whether you choose to save or invest really depends on your needs and preferences:

Saving may suit you if you’ve got a short-term savings goal - within five years – and you’re happy to receive steady growth.

Investing may suit you if you’ve got a longer-term goal – five years or more – and you’re willing to accept more risk in the hopes of stronger returns.

Always keep in mind, with investing there’s a risk that you could get back less than you put in. For example, if you need to withdraw funds while market conditions are poor.

You can have more than one ISA. For example, you might like to have a low-risk cash ISA that helps you save for short-term goals and a higher-risk investment ISA that potentially offers higher returns over a longer term.

Did you know: you can transfer an ISA from another provider to Lloyds. If you already have a Lloyds ISA, you can transfer it to another type of ISA with us.

Whether you’re new to investing or experienced, it’s always good practice to keep learning.

Important legal information

The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.