Change your business address

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

Apply online in minutes or via our mobile app. Bank anytime on-the-go, and pay no account fee for the first 12 months, £8.50 a month after that.*

Apply for a Business Account*Eligibility criteria apply.

Find the best products and support to help grow your business.

The Financial Services Compensation Scheme (FSCS) has increased the protection on your eligible deposits from £85,000 to £120,000.

Join the one million UK businesses that already bank with us.

For businesses with a turnover under £3 million.

Access a world of full-service business banking designed around you.

For businesses with a £3 million+ turnover.

Set yourself up for success with the right products for your business.

1

Discover specialist insight alongside products and services designed for your area of business.

Find out how we’ve supported a range of businesses and get insights to help you grow.

Beginning your business journey? Follow our 10 essential steps to turn your dream into a successful and sustainable start-up.

Discover how Island Delight accelerated business growth by unlocking working capital through Invoice Finance with Lloyds (2 min 42 secs).

We're proud to partner with Channel 4 on this initiative to elevate Black-owned businesses through the power of TV advertising.

Published August 2025

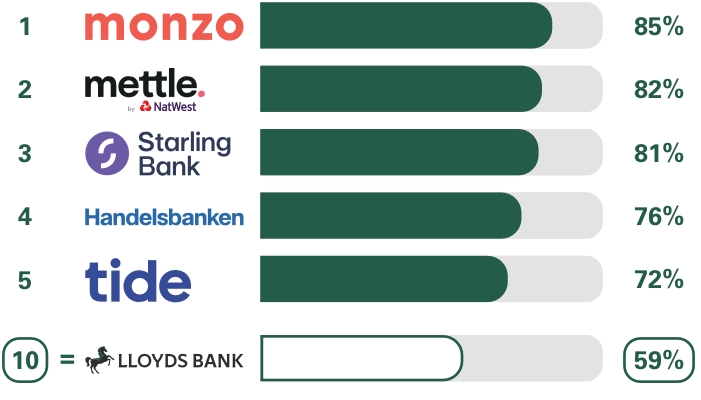

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 17 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here

We work hard to keep your personal and business data secure, which includes regularly reviewing our privacy notice. When there’s an important change we’ll remind you to take a look and share it with anyone within your business who might need to know. This is so you’re aware of how we use your data and what your options are. Please review the latest privacy notice.

All lending is subject to a satisfactory credit assessment and we will need your permission to carry out a credit check on you and your business.

You should not apply for an amount that you cannot comfortably afford to repay now and in the future to avoid the possibility of legal action.

All lending is subject to status. Security may be required.

While all reasonable care has been taken to ensure that the information provided is correct, no liability is accepted by Lloyds Bank for any loss or damage caused to any person relying on any statement or omission. This is for information only and should not be relied upon as offering advice for any set of circumstances. Specific advice should always be sought in each instance.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).