Go paper-free

Amend paper-free preferences for your statements and correspondence.

Get help with all your savings questions.

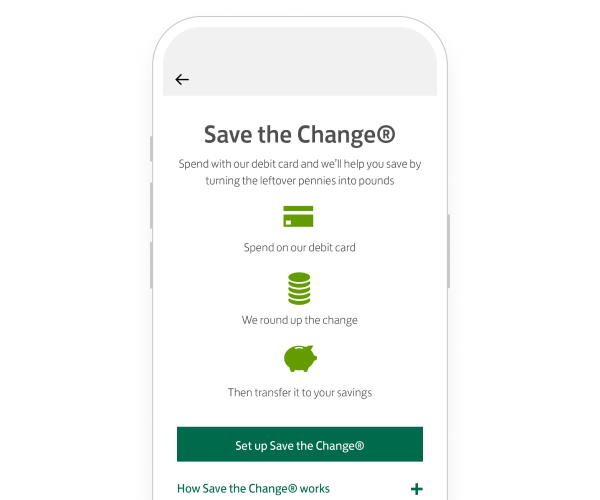

Save the Change® is a clever feature that takes your leftover change and turns it into bigger savings.

We want to make sure you know about our ISAs. Here’s some that may suit your needs.

Need help?

If you're registered for online banking, the fastest way to get in touch is by messaging us securely online.