Go paper-free

Amend paper-free preferences for your statements and correspondence.

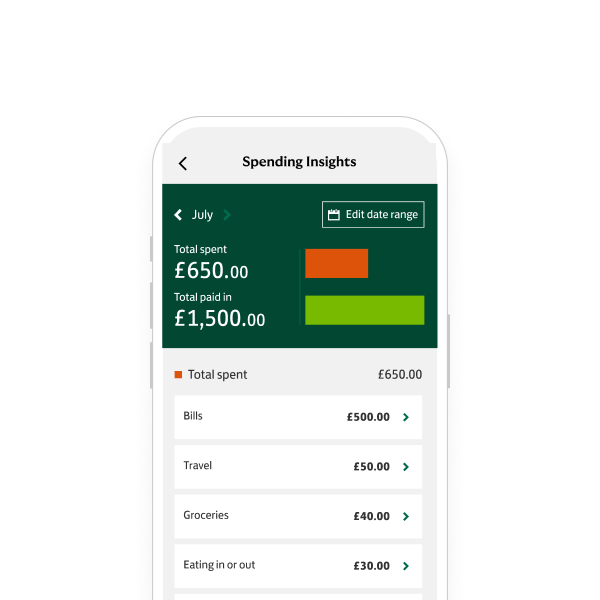

Keep track of how much you've spent and much more using our mobile banking app and online banking.

See your spending patterns with our quick and easy online tool.

Need help?

If you're registered for online banking, the fastest way to get in touch is by messaging us securely online.