Business cards

Work out how much cashback you could earn.

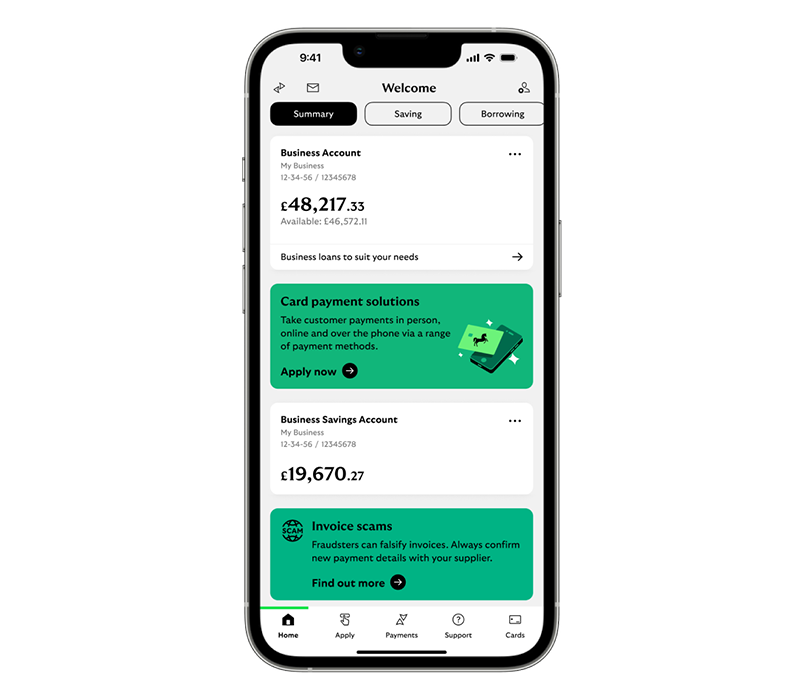

Stay in control of your business accounts when you’re on the move with our business banking app.

You need to be registered for Online for Business before you can start using our business banking app.

Find out how to register your device for our app.

When you download the mobile banking app, you can register your device in 3 simple steps.

If you're changing your mobile number, just download the app and install it again. The app works on most Apple iOS and Android devices.

Our app is compatible with standard device screen readers. This will help you use both mobile banking and the branch and ATM locator, if you have sight impairments. To use a screen reader, you'll need to enable the accessibility options in your device’s settings.

Yes, your username, password and memorable information are the same whether you use a computer or mobile device. If you don’t yet use memorable information, you’ll be asked to set it up the first time you use the app.

If you’re a personally connected customer, your log on details will be the same as for your personal accounts.

This is a timeout feature that stops you from accidentally leaving your bank account open on your mobile device. You'll be logged off automatically after a period of inactivity during your current mobile banking session. You can select how long this is in ‘Settings’ within the app.

If you lose your mobile phone, no-one can log on to your account without your memorable information. If this happens, call us immediately on 0345 300 0116.

Lines are open Monday – Friday 7am – 8pm and Saturday, 9am – 2pm. This is excluding bank holidays.

You can call us using Relay UK if you have a hearing or speech impairment. There's more information on the Relay UK help pages.

Sign Video services are also available if you’re Deaf and use British Sign Language.

“Jailbreaking” or “rooting” means removing safeguards from a phone so a wider range of apps can be installed, including unofficial ones.

When a device has been jailbroken or rooted, it makes it easier to install apps that haven't been properly screened for malware, leaving the device vulnerable to fraudulent attacks.

To keep our customers' personal information safe and secure, we don't allow jailbroken or rooted devices to access the app. If you decide to reset your phone to its original manufacturer settings, you should then be able to start using the new app.

If you've forgotten your Online for Business password or memorable information, don’t worry, you can reset it online. Simply click the ‘Forgotten your logon details?’ link and follow the instructions from there.

You can also reset your password through the app’s Settings menu. Select ‘Forgotten your password?' and follow the security steps to reset your password.

You can find the 'Deposit Cheque' in the three dot menu within the mobile banking app. You can also follow step by step guidance on How to deposit cheques.

Our Mobile Banking app is supported by devices running iOS or Android. The app is not compatible with some older versions of the operating systems – check the App Store or Google Play for more details.

If your phone has been subjected to unauthorised modifications (e.g. jailbroken or rooted) the app will not be compatible with your device.

Android/Google Play is a trademark of Google Inc. Apple, the Apple logo, Touch ID and Face ID are trademarks of Apple Inc, registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

It may be unlawful to use some Internet and Mobile Banking services in some countries. Please check before you travel. Services may be affected by phone signal and functionality.

We don’t charge you for Mobile Banking but your mobile operator may charge you for certain services such as downloading or using the app, so please check with them. You will need a smartphone running iOS or Android. The app is not compatible with some older versions of the operating systems – check the Apple App Store or Google Play for more details. Business Internet Banking registration required. Services may be affected by phone signal and functionality. Use of Mobile Banking is subject to our Business Internet Banking Terms and Conditions.