Go paper-free

Amend paper-free preferences for your statements and correspondence.

Personal financial advice to give you the opportunities, the life and the future you and your family deserve.

Schroders Personal Wealth has been awarded a 4.8/5 “Excellent” rating for the quality of service they provide.

Based on 1,247 reviews on Trustpilot as of December 2024.

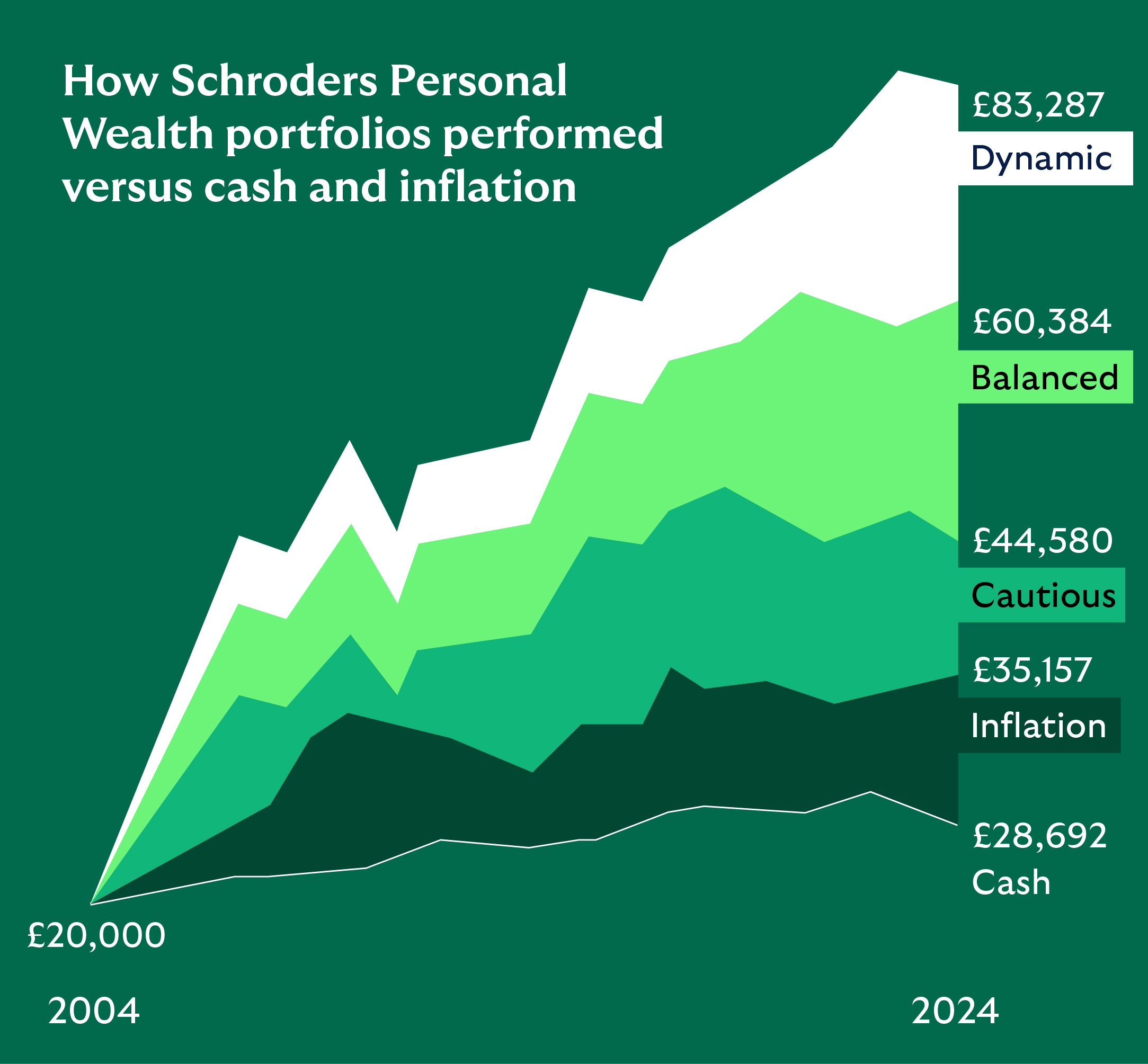

Help protect yourself against inflation and diversify more tax efficiently.

By investing you can pave the way towards financial growth and stability.

Make future plans and help ensure that you have the financial freedom to enjoy them.

If you’re retired or will be soon, see how we can help make the most of the funds you have.

Illness, injury or loss of income can impact you and your family.

The right plan can give you peace of mind and provide support if the worst should happen.

Pass on your wealth in the way you intend by taking full advantage of the tax opportunities available.

The value of investments and the income from them can fall as well as rise and are not guaranteed. The investor might not get back their initial investment. Tax treatment depends on individual circumstances and may change in the future.

Discover more about Schroders Personal Wealth in this introduction video and learn how Schroders can bring you from where you are now to where you want to be.

When considering financial advice, explore our articles to help you make an informed decision.

Your call may be monitored or recorded. Call costs may vary depending on your service provider.

Schroders Personal Wealth is a trading name for Scottish Widows Schroder Personal Wealth Limited. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales No 11722983. Authorised and regulated by the Financial Conduct Authority.