Go paper-free

Amend paper-free preferences for your statements and correspondence.

When building your business is all down to you, so is saving for your retirement.

We admire anyone who works for themselves. When you’re your own boss, that includes managing your financial future. Unlike employees, who get enrolled into company pension schemes, being self-employed means taking care of your pension yourself.

But with one of our pensions, we’re with you every step of the way.

Expert fund management done for you, leaving you to focus on other important things.

You control how your pension is managed up to and including retirement.

For every £80 you put into your pension, HMRC will usually add an extra £20. If you’re a higher or additional rate taxpayer, you could also benefit from extra tax relief through self-assessment. Tax treatment depends on individual circumstances and may be subject to change.

Discover how planning for your future today could make things easier when you decide to retire.

Regularly contributing to your pension is a way of keeping your tax bill to a minimum.

Personal Pensions will protect your money from tax, meaning you won’t pay income tax or capital gains on your investments. But unlike savings accounts and ISAs, the government gives you tax relief on the money you pay into your pension.

The way you claim this tax relief depends on how your business is set up.

If you’re a sole trader (or part of a partnership)

If you work for your own limited company

When you reach your planned retirement age, you can access your pension in several ways, taking up to 25% as a tax-free lump sum. The rest is subject to your standard level of income tax.

How and when you take your pension depends on what you want for your retirement. Please see the Retirement options page for more information.

If you’re self-employed, making regular contributions to a pension can feel like a significant commitment. Especially if your earnings fluctuate and cash flow is always on your mind.

With our Ready-Made Pension, you can start by contributing just £150 a month (including tax relief) and even less with our SIPP from just £1. Plus, you can stop or increase the amount at any time and top up with lump sums when business is going well.

You don’t need to choose between investing in your business or investing in your pension. It’s good business to do both.

Nobody wants to work forever. As you get older, you’ll probably want or need to slow down. And that can be tricky if your business is your only source of income.

By saving into one of our Personal Pensions, you’re essentially creating another source of income to support you in retirement. It means that if you want to keep on working you can do so because you want to – not because you need to.

The rising cost of living could potentially eat away at the spending power of your money over time.

It’s important to give your long-term savings the best chance to grow and putting your money into a pension does just that.

The money you put into a pension is invested in different assets, such as shares and bonds. Over time, these tend to generate higher returns than cash left in a standard bank account.

And because HMRC tops up your personal contributions by adding back the basic rate of tax, more of your money is invested. This could help your pension grow even more.

If you were employed before starting your own business, you may have one or more old pensions you’ve left untouched.

You might be able to transfer those pensions into your Lloyds Pension. Combining your pensions makes it easier to keep track of your retirement savings.

After years of working, many of us hope to make the most of our retirement – whatever that looks like for you.

When you die, it’s good to know that your loved ones can inherit your pension.

If you die before the age of 75 your beneficiaries can normally access all the money you’ve saved, without paying any income tax.

If you’re 75 or over when you die, your beneficiaries may have to pay income tax depending on how they access the pension.

Important note: Pensions will be included in a person's estate for inheritance tax purposes from April 2027.

Investing in a pension generally offers higher potential returns compared to saving, which is crucial for building a robust retirement fund.

If you’re years away from retiring, you could consider taking more risk in your investments, giving your fund the best chance of growth. As you approach retirement, to help protect your pension value, lower-risk investments may be more suitable.

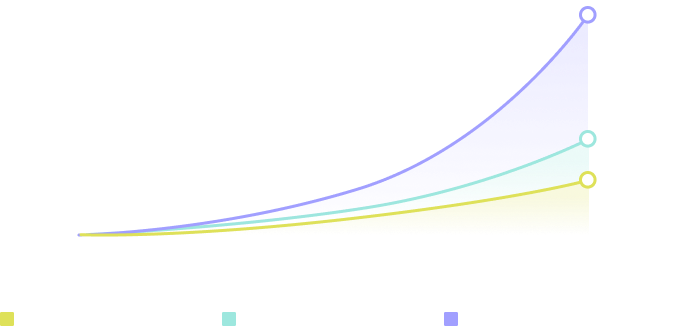

If you invest £10,000 initially and contribute £250 monthly from age 25 (minus an account charge of 0.3%), By age 65 you could have roughly:

£245,000 if markets achieve a low growth of 3% per year

£415,000 if markets achieve medium growth of 5% per year

£970,000 if markets achieve higher growth of 8% per year.

Please note that this graph is a guide for illustration purposes only and not a reliable indicator of future performance.

Combining your old pensions can make retirement planning easier.

Find out more about pensions and how you could benefit from one for your retirement.

We can help you access your pension when it suits you best.