Go paper-free

Amend paper-free preferences for your statements and correspondence.

Do you often find yourself making unplanned purchases? Do you think you enjoy shopping or spending a little too much? Are you buying things because you want them rather than need them?

If your spending is beginning to worry you, here are some ideas to get back control of your money.

Ask yourself these questions to change your habits.

Get started by using our budget calculator to understand your income and spending.

Once you have a budget, set yourself a monthly plan and stick to it. Remove the risk of unnecessary spending by changing your contactless limit, blocking notifications from shops and takeaway services and deleting the apps that tempt you.

Small changes can help you control your compulsive spending. Our budgeting tips page has lots of really helpful tools, guides and calculators to start making your budget today.

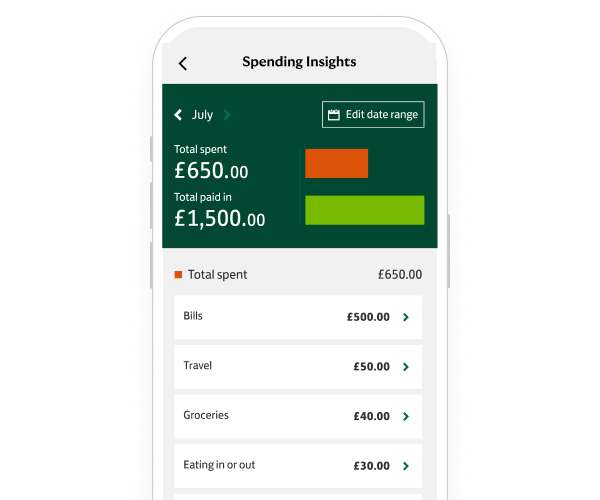

Online tools help you monitor your spending and understand your habits. Use spending insights and app notifications to do this, or quickly freeze and unfreeze different types of transactions on your cards.

Take control and manage your credit card balance, credit limit and repayments and cancel any subscriptions you don’t need.

If you’ve started to take control of your spending habits, you might need some support to get your debt under control.

We’re here to help you reduce the cost of your credit and manage your bills. Don’t forget any credit cards – watch your balance, credit limit and repayments. You can also understand the cost of borrowing, including interest, fees and charges.

You can also check your credit score for free with no impact on your credit file. This can help boost your understanding of credit, what affects your score and how you could improve it.

Having a goal can help you fight the urges. We’ve got savings calculators to help set a realistic goal, or maybe our savings challenge could help you fight the urges to splurge.

We also have lots of information and guides to help you set up a savings habit that might just replace your spending habit and help you understand how to stop spending money you might regret.

There are other organisations that offer free and independent support to help you get control of your spending habits.

Get practical debt and savings solutions from StepChange to help get you back on track. We’ve also partnered with PayPlan who offer a personalised action plan for your money, with support available online or over the phone.

If money worries are affecting your mental health, Mental Health and Money Advice are there to offer clear, practical advice and support to help you.