Business cards

Work out how much cashback you could earn.

Our accounts come with everything you need to help make managing your finances easy.

Open an accountWhether you’re just starting your business, turning a side-hustle into your day job or you’re a freelancer or contractor, our Business Accounts come with the tools you need to make managing your business finances a breeze.

Get an instant decision on up to £5,000 credit* as a start-up across a credit card or overdraft to help you manage your cash flow and get things off the ground.

Manage your business expenses, free up cash flow and earn rewards with our Credit and Charge Cards. You’ll get up to 56 days’ interest free credit, travel insurance and you can earn cash back on eligible purchases.

Our payment solutions can help you take the hassle out of taking payments, however your customers choose to pay.

Get a 60-day free trial and discounts on Norton Small Business plans.

Find out more about our Business Account fees and charges.

|

Payment type |

|

|---|---|

|

Payment type Introductory offer |

No monthly account fee for 12 months |

|

Payment type Monthly account fee |

£8.50 after 12 months |

|

Payment type Electronic payments in1 |

Free |

|

Payment type Electronic payments out1 |

First 100 a month are free / £0.20 each after that |

|

Payment type Cash payments (in or out) |

£0.85 for every £100 at an Immediate Deposit Machine / £1.50 for every £100 over the counter |

|

Payment type Cheques (in or out, any amount) |

£0.85 at an Immediate Deposit Machine / £1 over the counter |

|

Payment type Credit paid in at branch or ATM |

£0.85 |

|

Payment type Credit paid in at an Immediate Deposit Machine, Automated Deposit Machine, through the app |

Free |

|

Payment type BACS |

File submission: £5.50 BACS Item: £0.15 (a set up fee may apply) |

|

Payment type CHAPS |

£30 |

|

Payment type Sending and receiving money abroad |

|

|

Payment type Balances below £0 (going overdrawn) |

|

|

Payment type Other account services |

Yes, you can open a business bank account online if your estimated turnover for the next 12 months is under £25 million.

Having a dedicated business account has lots of benefits. Limited companies are legally required to have one and although freelancers and sole traders aren’t, running your business through a business account can help make things easier.

Yes, if you are a sole trader running your own small business or self-employed. While you’re not legally required to have a business account, keeping all your business transactions in one place can make managing your finances easier.

Eligible deposits with Lloyds Bank plc are protected up to a total of £85,000. Due to eligibility criteria, not all business customers will be covered.

Published February 2025

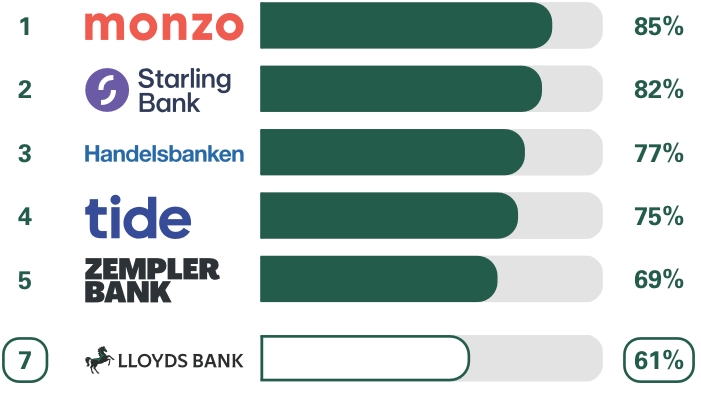

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 16 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here

*Apply online once your new Business Account is set up and you’ll get an instant decision. Eligibility for lending will be assessed as part of a separate application, and there is no guarantee of lending being granted. All lending is subject to status.

1Electronic payments include: