Go paper-free

Amend paper-free preferences for your statements and correspondence.

If you’re paying off your credit card balance, it’s important to know about residual interest.

In simple terms, it’s the interest calculated on your balance in the days between your statement being issued and you making a full statement balance payment.

It doesn’t always apply though, so make sure you read through the detail below to gain a full understanding.

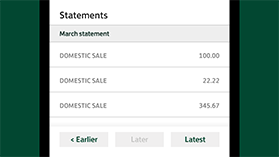

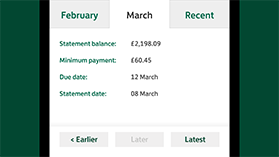

We’ve shown some figures, just for illustrative purposes:

You haven’t used your credit card in over a month so, when your latest statement arrives, you decide to pay off the balance shown in full.

The amount shown on your statement is £2,198.09. This includes all interest charged up until the date the statement was produced, but not any interest that’s accumulated since.

It’s useful to remember that interest is calculated daily, then charged on the following monthly statement.

You decide to make a payment of £2,198.09 using your debit card.

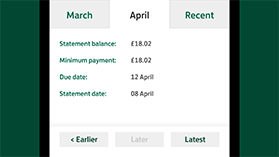

Your next statement arrives. At this stage, you haven’t used your credit card in over two months. The statement balance is £18.02, which covers the ‘residual interest’ charged between your previous statement being produced and the date your last payment reached your account.

You make a further payment of £18.02 which then clears your balance in full.

As that £18.02 is purely interest, we won’t charge further interest on that amount. Some lenders may refer to this as a ‘final interest charge’.

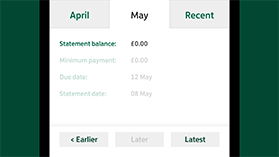

You will receive a final statement, but this time it’ll show your balance as paid in full.

No further statements will be issued while there's no balance to pay and new account activity.