Change your business address

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

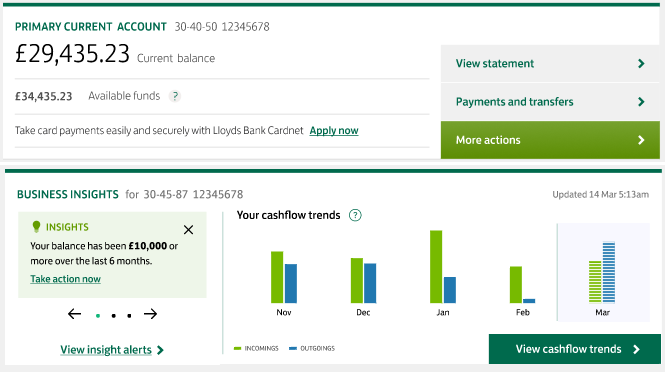

Business Insights uses your everyday banking data to give you a clear view of your cash flow. Helping you plan ahead and make more informed decisions. If cash flow challenges arise, we’ll suggest ways to stay on track.

Log in to Online for Business to see your Business Insights.

We’ll highlight key patterns and opportunities in your data through helpful messages.

Business Insights analyses your Business Current Account activity. This data is transformed into insights, creating a clear picture of your cash flow: a deep dive into your incomings, outgoings, balance and other trends that provide a fuller understanding of your business and finances.

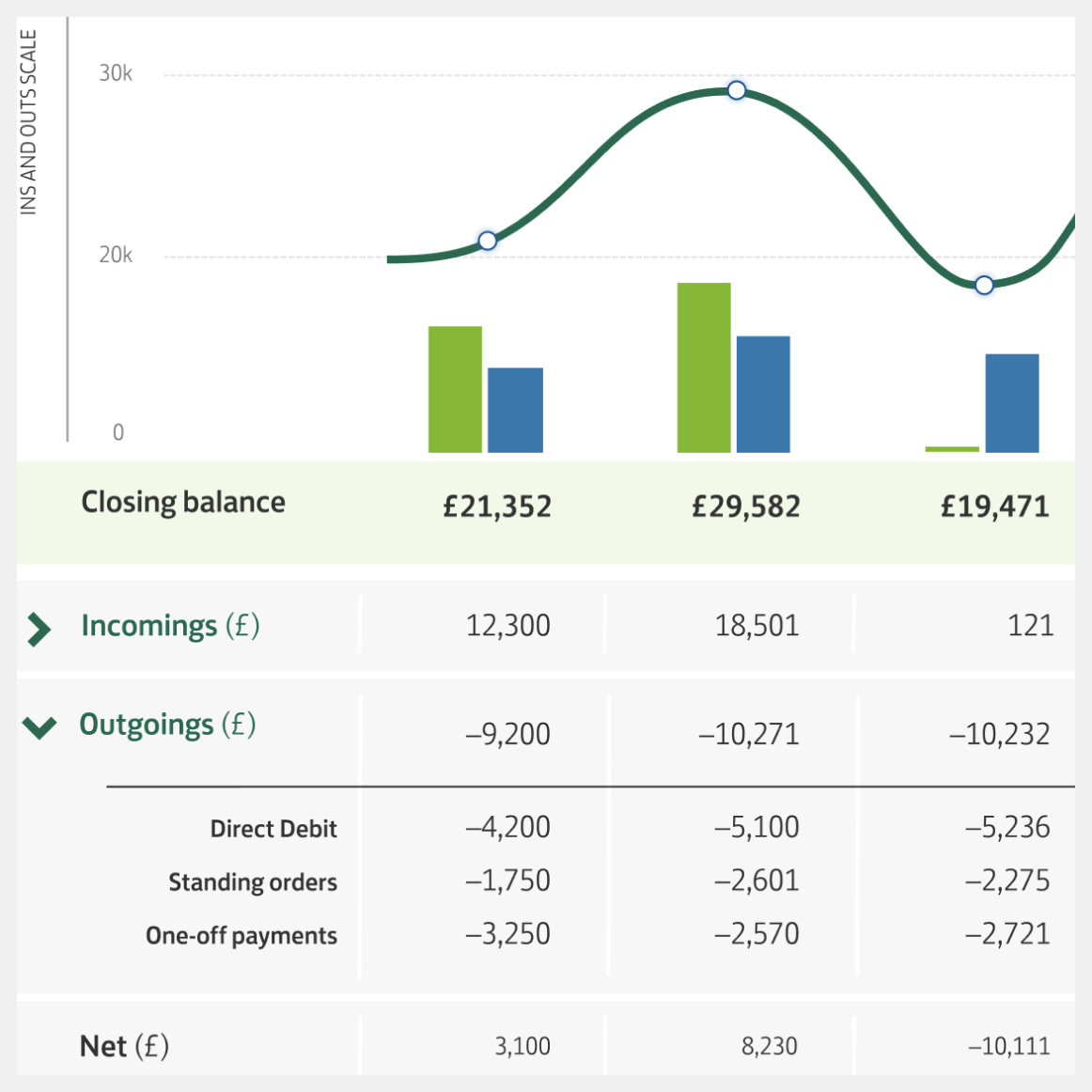

The past incomings, outgoings and balance of your Business Current Account over a period of time.

The amount of money that's paid into your Business Current Account over a period of time.

The amount of money that's paid out of your Business Current Account over a period of time.

The difference between the incomings and outgoings of your Business Current Account over a period of time.

When you don't have enough cash in your Business Current Account to cover your outgoings.

When there's cash left over, after paying for the business's operational needs and outgoings for a certain period.

Our team is here to help with any issues or questions. Lines are open Monday to Friday 8am to 6pm and Saturday 9am to 2pm. This excludes bank holidays.