Business cards

Work out how much cashback you could earn.

Read time: 7 mins Added date: 21/11/2024

To liquidity and beyond.

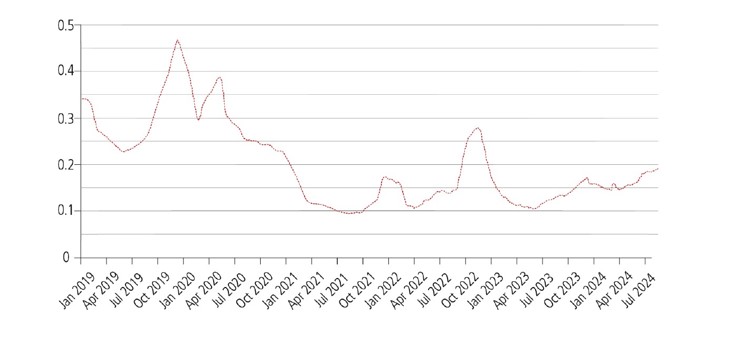

The UK pension industry is navigating a new and complex landscape. Quantitative tightening, alongside changes to central bank emergency facilities, is starting to impact central bank money, while markets are pricing in further Bank Rate cuts, opening up the potential for schemes to distribute any surplus, or move to buyout. This has resulted in a continued slow grind higher in traditional repo funding levels (Chart 1).

At the same time, a number of recent macro events have led insurance companies and pension funds to prioritise liquidity risk. There is an increased focus on improving funding and diversifying liquidity sources, as many funds recognise that they were overly dependent on conventional and index-linked gilts.

Chart 1: Evolution of 1-year repo funding cost

One-year indicative gilt bid versus one-year sterling overnight index average (Sonia) (2019-present) 60-day moving average (%). Source: Lloyds data for gilt LDI bid; Blomberg data for SONIA, 23 September 2024.

While this backdrop poses challenges, it also creates opportunities. Many funds are looking afresh at alternative solutions around funding and liquidity, including structured repo transactions, and broadening the eligible collateral under their credit support annexes (CSAs) in order to create synthetic liquidity facilities. These approaches can cover day-to-day liquidity management, as well as managing the challenges associated with moving to buyout, a growing annuity fund, or implementing asset strategies. They include:

The range of options available in today’s rapidly evolving environment can sometimes seem overwhelming, but support is available.

As a longstanding counterparty in repo transactions for financial institutions and a leading GEMM and hedging counterparty in conventional and inflation-linked gilts and derivatives, Lloyds has a wealth of expertise and experience in pricing risk, which it puts to use in developing tailored solutions to individual client challenges.

The bank looks to manage the market, liquidity and funding risks it assumes from insurance and pension fund clients by offsetting them against its significant corporate client business and its own lending activities. Crucially, all the teams work closely together to ensure clients receive the best solutions.

Lloyds has partnered with some of the UK’s top companies, delivering solutions that draw on the bank’s wide-ranging strengths and commitment to innovation. Examples include recent collaborations with insurance companies to fund their gilt and corporate bond holdings via repo for multiple years; analysing a client’s collateral positions in stressed environments and facilitating the use of corporate bonds as collateral for margin posting; and serving as the sole derivatives counterparty in a number of multi-billion-pound bulk annuity transactions.

We stand ready to assist both new and existing clients in creating more diversified and sophisticated liquidity and funding solutions for schemes either in run-on or having moved to buyout. As liabilities continue to shift from pension funds to insurance companies, and funding costs rise further as funding schemes wind down, taking a proactive approach to identify opportunities while conditions remain favourable is a prudent long-term strategy.

Lloyds is also spearheading discussions with clients around innovations such as distributed ledger technology, which could facilitate the use of tokenised money market funds as collateral, for example.

Article first published in Risk.net, November 2024.

For the latest insights follow our dedicated LinkedIn channel for corporates and institutions.

The Markets Conversations is a monthly podcast, sharing insights from the trading floor.

A series of 30-minute webinars on financial risk management topics for treasury teams.

Stay ahead of upcoming economic events with our weekly look-ahead report.