Change your business address

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

Read time : 19 mins Added: 12/08/2022

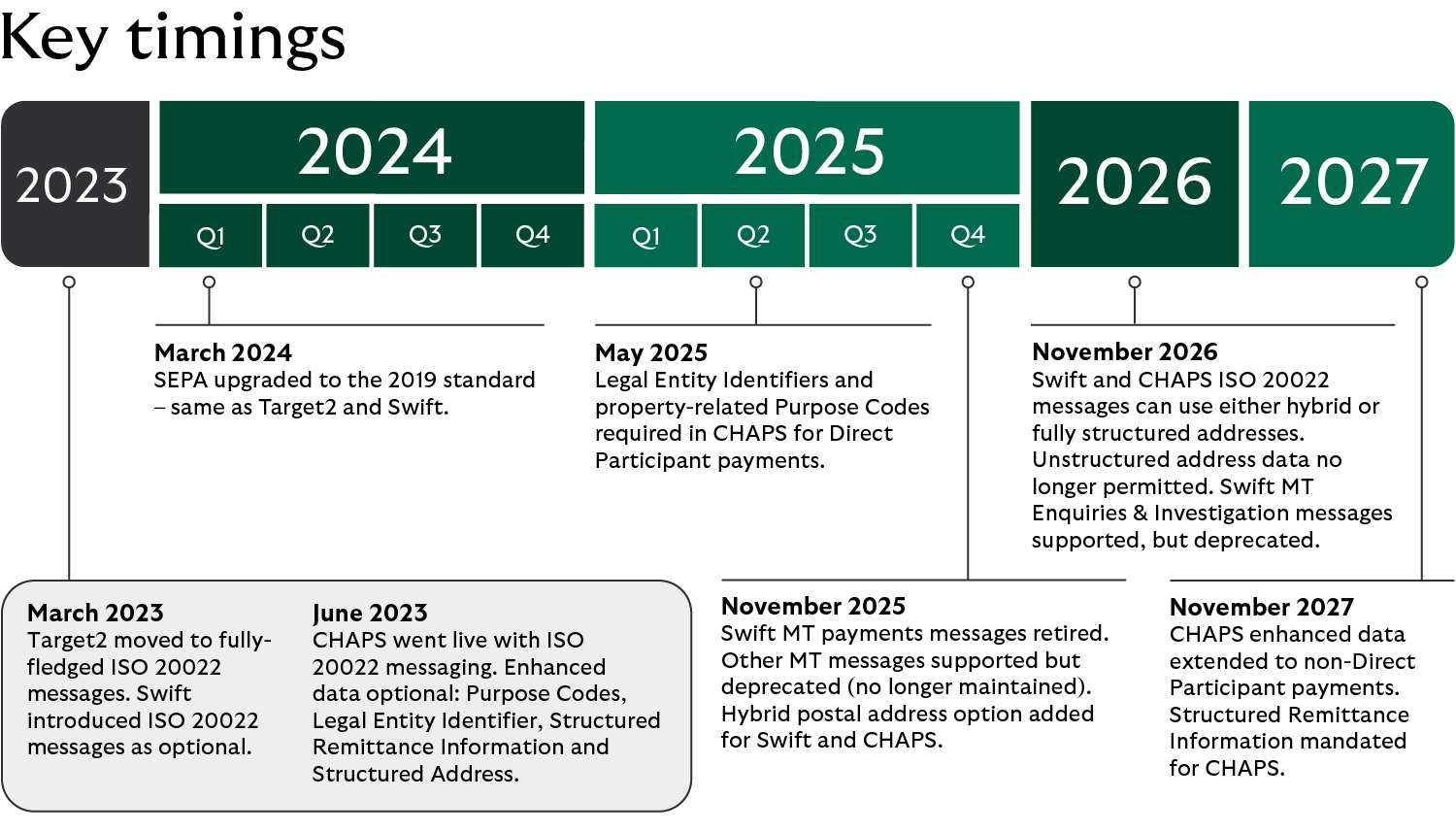

Timelines described below are subject to change by industry bodies. Date last amended: May 2025

Banks and businesses across the globe are preparing to change the way payments are communicated. A new messaging standard called ISO 20022 is being adopted that will allow more data to be included. Below we outline what you need to know about the new messaging standards, key dates and what Lloyds is doing to support clients during the transition period.

Depending on where they come from, payments are often in different “languages” - using varying messages, formats, codes, and fields all strung together with different integration types. Get any of this information wrong and it could delay your payment, causing unnecessary stress. ISO 20022 aims to change all of that and make sure that, when we make a payment, we’re all speaking the same language.

ISO 20022 is a standard suite of structured data formats used in the processing, management, and reconciliation of payments. It provides an increased amount of richer data and enhances every stage of the payment journey.

In the coming years you can expect to see the processing of payments speed up. And the enriched data that comes with them will mean you will be able to reconcile incoming transactions more easily, with less manual intervention.

Swift – which owns and operates the world’s payment infrastructure – is in the process of adopting the ISO 20022 format globally. They aim to have the core payment migration complete by November 2025. Swift is mandating those who use their infrastructure to adopt the format as well, so that every bank, everywhere, uses the same language.

From May 2025, CHAPS payments between Financial Institutions will require the use of Legal Entity Identifiers and Purpose Codes, with Purpose Codes also being required for property related transactions.

Lloyds will be introducing the option to include this information before the end of 2024, allowing clients to become familiar with the new requirements ahead of the mandatory date.

November 2025 sees the completion of Swift payment migration to ISO 20022. It will also see the introduction of hybrid address options for Swift and CHAPS, which will require a minimum of town/city and country populated in specific fields.

From November 2026 all Swift and CHAPS payments will need to use either fully structured or hybrid addresses. Unstructured addresses will no longer be supported and should not be used. Structured remittance information will become mandatory for CHAPS from November 2027.

Benefits

Over time businesses will see a number of benefits from the introduction of ISO 20022:

Considerations

While much of the heavy lifting will be undertaken by us (or your Bank), there will be a number of things that corporates will need to consider:

Benefits

Over time financial institutions will see a number of benefits from the introduction of ISO 20022:

Think about your own migration journey

Our ISO 20022 journey began in 2016 as we looked to develop our plans to:

The major outcome of this was the design and build of Lloyds Bank Gem®. Offered to Corporate and Institutional firms, this is our ISO 20022 and API-enabled cash management and payments platform, as well as our International Payments Platform.

To find out more about ISO 20022 or to see if Lloyds Bank Gem is suitable for your business, speak to your relationship manager.

Below is a summary of the current Swift MT formats and their MX ISO 20022 equivalents.

|

Existing FIN MTs |

ISO 20022 equivalent |

|---|---|

|

Existing FIN MTs MT 101 relay |

ISO 20022 equivalent pain.001.001.12 (Interbank) |

|

Existing FIN MTs MT 102 MT 102 STP MT 103 REMIT |

ISO 20022 equivalent pacs.008.001.12 |

|

Existing FIN MTs MT 103 MT103 /RETN/ |

ISO 20022 equivalent pacs.008.001.12 pacs.004.001.13 |

|

Existing FIN MTs MT 103 STP MT 192 |

ISO 20022 equivalent pacs.008.001.12 camt.056.001.11 |

|

Existing FIN MTs MT 196 (Response) |

ISO 20022 equivalent camt.029.001.13 (ONLY as a response to camt.056) |

|

Existing FIN MTs MT 200 |

ISO 20022 equivalent pacs.009.001.11 |

|

Existing FIN MTs MT 201 MT 202 |

ISO 20022 equivalent pacs.009.001.11 pacs.009.001.11 |

|

Existing FIN MTs MT 202 (with reimbursement Agents – Fields 53 and 54) MT 202 COV |

ISO 20022 equivalent pacs.009.001.11 – ADV pacs.009.001.11 COV |

|

Existing FIN MTs MT 202 /RETN/ MT 203 MT 204 |

ISO 20022 equivalent pacs.004.001.13 pacs.009.001.11 pacs.010.001.06 |

|

Existing FIN MTs MT 205 MT 205 COV |

ISO 20022 equivalent pacs.009.001.11 pacs.009.001.11 COV |

|

Existing FIN MTs MT 205 /RETN/ |

ISO 20022 equivalent pacs.004.001.13 |

|

Existing FIN MTs MT 210 |

ISO 20022 equivalent camt.057.001.08 |

|

Existing FIN MTs MT 292 MT 296 |

ISO 20022 equivalent camt.056.001.11 camt.029.001.13 (ONLY as a response to camt.056) |

|

Existing FIN MTs MT 900 |

ISO 20022 equivalent camt.054.001.12 |

|

Existing FIN MTs MT 910 MT 920 |

ISO 20022 equivalent camt.054.001.12 camt.060.001.05 |

|

Existing FIN MTs MT 940 MT 941 MT 942 |

ISO 20022 equivalent camt.053.001.12 camt.053.001.12 |

|

Existing FIN MTs MT 950 |

ISO 20022 equivalent camt.053.001.12 |

Cross-border Payments and Reporting Plus (CBPR+) is a market practice defining how ISO 20022 will be used for cross-border payments and cash reporting on the Swift network.

High-Value Payments Plus (HVPS+) is a market practice originated as part of the ISO 20022 harmonisation initiative. It defines how ISO 20022 should be used for high-value payments market infrastructures such as CHAPS.

Both sets of standards are available on Swift MyStandards.