Change your business address

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

Read time: 5 mins Added date: 21/10/2024

From going to the polls to achieving Olympic golds, this summer has offered a frenzy of high-profile events that have made a significant impact on the hospitality sector. But what can spending trends reveal about consumer behaviour this year, and what should be on the minds of hospitality leaders as we approach Christmas?

To understand more, Lloyds Bank Market Intelligence analysed aggregated and anonymised data from Lloyds Banking Group’s 26 million retail customers across Great Britain. We can help hospitality leaders understand more about their own customers, their locations, and the wider market.

Between sports, a general election and a few hot spells, this summer boasted many events capable of drawing people out to Britain’s hospitality venues. It’s therefore no surprise that on the day of the European Championships final, transactions in pubs and restaurants increased by 35% in value and 63% in volume compared to the same day in 2023.

Although this summer has offered more showers than scorching temperatures, people in Britain made the most of the sunshine while it was here. The year’s hottest weather in the final week of July sparked 9% higher transaction values, and 10% higher volumes, compared to the same week in 2023.

While this may seem logical, what surprised us the most were some of the underlying trends at play.

It’s interesting to see that although the summer was generally positive, consumer spending was considerably different depending on generation.

The older generations have increased their spending significantly more than their younger counterparts. In June 2024, over 60s averaged 12.8% transaction value growth and 9.1% transaction volume growth, while under 60s averaged just 4.5% and 1.4% respectively.

We saw a similar story in July too. The total value of transactions among over 60s increased by 10.0% and their transaction volumes increased by 11.6% year-on-year. By contrast, the overall spend value among under 60s decreased by 1.8% and the growth in transaction volume was flat, perhaps influenced by one fewer weekend in the month.

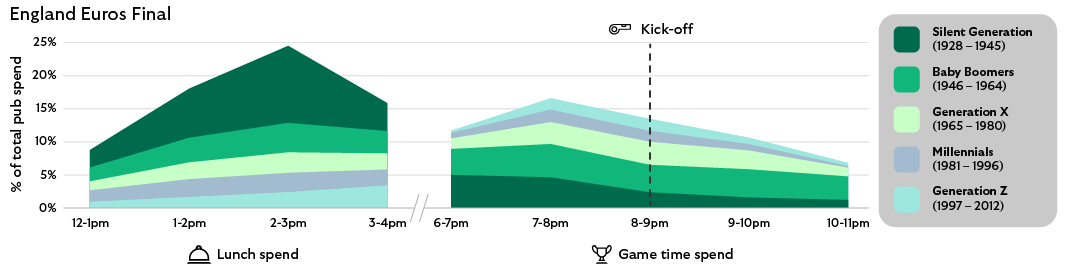

However, despite the increased spend by the over 60s, the final match of the Euros was not enough to tempt them to stay in the pub. In England, Gen Z spent 59.1% of their total pub value for that day around the time of the game – between 6pm and 11pm. By comparison, Millennials spent 53.7% during this time, Gen X 48.1%, Baby Boomers 35.6%, and the Silent Generation only 14.7%.

Interestingly, Baby Boomers and the Silent Generation both spent the largest portion of their pub spend value (41.2% and 67.1% respectively) on the same day during the lunchtime hours of 12pm to 4pm. This goes to show that, when faced with a choice between gravy or goals, the older generations are likely to choose a Sunday lunch.

The coverage of the general election on Thursday 4th July continued overnight and into the early hours of the next day, potentially impacting hospitality spending. Hospitality transaction value and volumes on Friday 5th July – the day after the election – were 7% lower than the average on Fridays in July 2023, possibly suggesting that people had stayed up late the night before watching the results.

However, the day of rest proved to be effective; for the rest of July, hospitality spend values and volumes were both up an average of 8% year-on-year.

This may be part of a wider rebound in business confidence in July. Responses analysed by Lloyds Banking Group’s July Business Barometer, mostly collected after the general election, revealed that hiring intentions, price expectations, and trading prospects were all trending upwards. Our data teams are working with our hospitality clients across the country to see if this post-election bounce and higher business confidence translates into good news for Britain’s pubs and restaurants, and whether it changes or accelerates any of the trends that we have seen over the last two years.

As winter approaches, hospitality leaders are beginning to look ahead to the Christmas period. With access to spending data from last year, Lloyds Bank Market Intelligence can offer revealing insights into potential trends for the upcoming season.

Last year, pubs captured a greater share of overall hospitality spend in December, with a 4.7% growth in the share of transaction value and a 5.8% growth in the share of transaction volume compared to the year before. The increase in pub spend, however, varied dramatically across the country. Welsh pubs recorded a 23.5% increase in year-on-year spend value, and a 21.7% increase in transaction volumes in December 2023, compared to London’s 8.5% year-on-year increase in spend value, and 7.9% increase in spend volume.

Every age group spent more in pubs and restaurants in December 2023 compared to December 2022. However, the number of transactions made by Gen Z in restaurants slightly declined by 0.3%. The general increase in number of transactions in restaurants was positively correlated with age – rising from -0.3% (Gen Z) to 19.4% (the Silent Generation). This was the same in pubs, rising from a 5.2% increase (Gen Z) to a 33% increase (the Silent Generation).

However, when we look at transaction value, there is a different story. In restaurants, the average value per transaction was still positively correlated with age – Gen Z’s average transaction value increased by 1.9% year-on-year, while the Silent Generation’s increased by 4.1%. However, in pubs there was a reversal of this trend. While Gen Z’s average transaction value increased by 1.5% year-on-year, the Silent Generation’s decreased by 2.2%.

This means that older generations are making far more purchases in pubs, but are spending less per transaction on average. Through these insights, we can identify the demographic segments most valuable to you, and examine both how they spend at your locations, and where else they are spending their money.

We are constantly analysing consumer behaviour impacting the hospitality sector, and our teams dive deeper to provide actionable insights. As a hospitality operator, we can help you better understand your customers, allowing you to plan your next move, identify growth opportunities, and stay ahead.

Using demographic data, time of day analysis, and peer group mapping – all of which is aggregated and anonymised – we’re able to check if you’re losing certain customers to your peers at particular times of the day. This can allow you to explore factors such as time-sensitive promotions that may be luring business away. With localised insight, we can help you understand how local consumer behaviour is impacting each of your locations.

2024 has so far seen some key events that have influenced consumer spending in the hospitality sector, and now is the perfect time to put these insights into practice ahead of the Christmas season.

For the latest insights follow our dedicated LinkedIn channel for corporates and institutions.