Business cards

Work out how much cashback you could earn.

Read time: 5 mins Added date: 11/12/2024

Reliable relationships and support are critical to running a business. Having the right support from your bank can take a weight off your mind so you can focus on growth. This case study highlights how Lloyds delivered for a global tech sector client.

From its background as a healthcare provider operating from physical pharmacy stores, in 2018, Infohealth made the bold move to strategically position itself in the digital space. Spotting an opportunity to capitalise on the growth of the online market segment and the gap in the market for digital clinical services, in 2020, the company acquired the digital assets of Now Healthcare Group, which operated GP services at a distance, through its brand NowPatient.

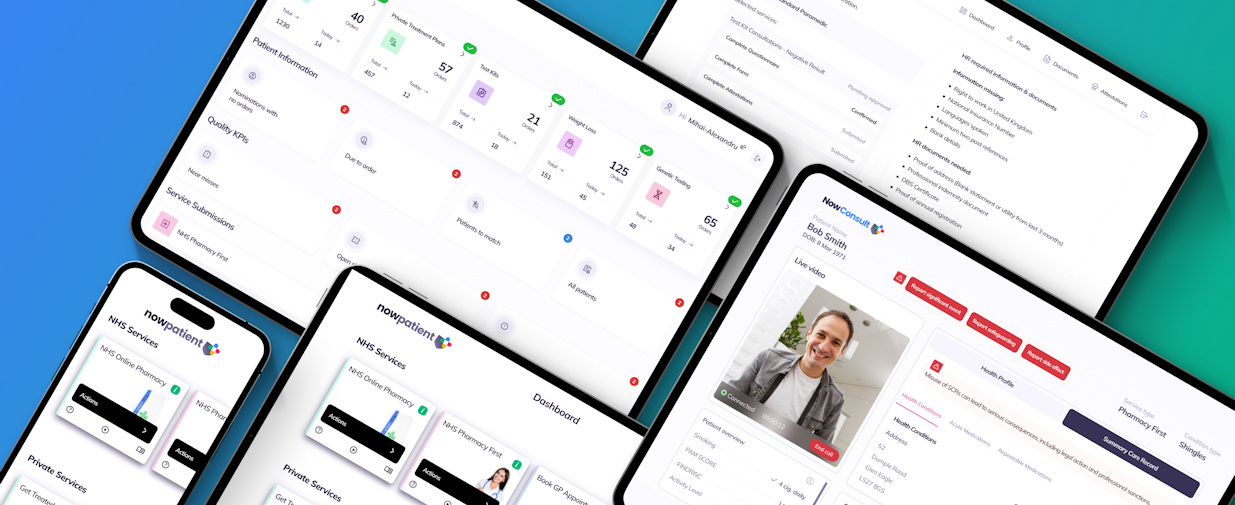

Following a multi-year investment programme, NowPatient was stripped back and technologically re-engineered to become an online pharmacy & telehealth platform operating within UK and US health systems. The platform allows users to access AI-healthcare tools, prescription savings programs, treatments and more.

Rajive Patel is Infohealth’s Product Lead and Director. He heads a full-stack product team of 20, including engineers, data scientists, marketers and clinicians.

Rajive has led NowPatient through this intense period of development and has overseen a number of tech initiatives to enhance their offering. One such project was creating a best-in-class compliance and security-led clinical consultation platform capable of handling virtual consultations in the UK and US.

Another significant milestone has been building an integration with NHS England to allow NHS-commissioned clinical services to be provided seamlessly and remotely to service users, improving access and boosting patient outcomes.

With more developments in the pipeline and ambitious plans for the future, it’s vital Infohealth has a banking provider that understands the business and provides proactive advice on the financial landscape in global markets.

While you may think this would be a given, Rajive found this lacking from his previous bank, causing issues as they looked to expand. “As we were making a big bet with our multi-year investment, I discovered our previous bank simply didn’t share our vision,” he comments.

With the business needing advice on paying suppliers in USD, handling receipts and multi-currency payment processing solutions, maintaining the status quo would have had a detrimental impact, because you can’t grow a business through guesswork.

After speaking with several potential providers, Rajive switched to Lloyds after chatting with Danny Burton, Relationship Manager for SME Banking, Media, Technology & Creative Industries.

“Danny was considerate, understanding and genuinely interested in what we were doing. He then provided a package of banking services to fit our commercial goals. Lloyds’ multi-currency payment processing service in particular was critical to our future operations, and the help we received in building the integration was excellent. Our developers had a fantastic experience,” Rajive enthuses.

Relationships are built on trust, whether between a doctor and their patient or a business and their bank. Lloyds has a dedicated specialist tech team with sector experts ready to support fast-growth customers like Infohealth as they navigate scaling up. Danny’s initial insight and ongoing support have allowed Rajive and his colleagues to focus on their service and reduce financial uncertainties.

From Danny’s perspective, the relationship is about honesty, taking time to understand what the business needs and its challenges. “I’ve been helping Rajive since November 2022 and he knows I’m always here for him as the business encounters growing pains in new markets. From currency accounts and corporate charge cards to payment gateway solutions for online and retail pharmacies, we’ve played our part in driving the business forward. And he doesn’t need to go through a call centre to chat to me either,” he affirms.

“It can be incredibly frustrating when you need answers and support from your bank that aren’t forthcoming.” Rajive doesn’t want others to go through the same experience. “Don’t ignore banking. It's critical to executing your strategy. You need to find a reliable provider rather than just going by cost. A relationship manager should work with you and be a good sounding board. They can also present solutions, some of which you may not have previously considered,” he advises.

NowPatient is set for significant growth by exploiting its new revenue channels across multiple global markets and reaching 1 million registered customers in the next two years. There’s clear potential to achieve this, with the telehealth sector having a forecast global Compound Annual Growth Rate (CAGR) of 24.3%.

Rajive sees a bright future ahead in wearable health tech developments, in particular. “Currently, some remote telehealth services are limited by the availability of real-time data such as blood pressure readings, meaning patients have to visit their provider to be physically assessed. New technologies mean we can break down barriers to remote assessments by providing remote clinicians with real-time vital data in the form of a bracelet or ring,” he concludes.

The changing face of global healthcare demands strong financial foundations and Lloyds is providing the platform for future success to be built on.