Business cards

Work out how much cashback you could earn.

Read time: 5mins Added: 23/05/2023

Online payments provide a means of getting money from your customer or donor to your bank account.

It’s worth taking the time to understand how an online transaction process works. You will then know how long it will take and what is involved. But first, you’ll need to understand some of the terminology involved.

Online payments allow you to easily make and receive payments from your customers or suppliers. This guide sets out the process and how long payments take.

A merchant account is an account that exclusively holds funds from card transactions. These funds are regularly transferred to your organisation’s bank account by your Merchant Acquirer.

An Issuer / Issuing bank is the bank (or financial institution) that issued a customer with their card and maintains a contract with them for repayment of card transactions.

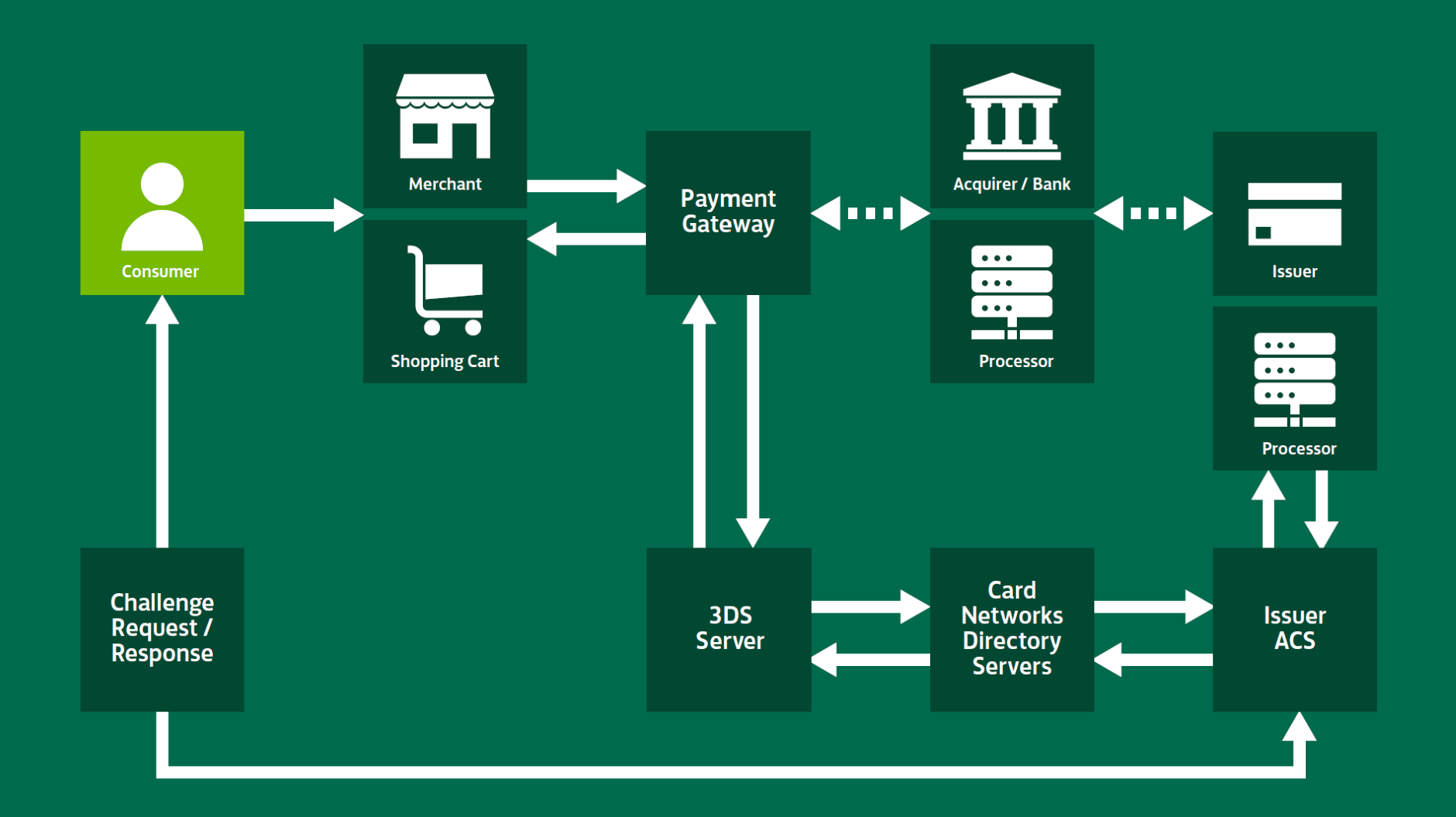

A payment gateway is a service provider, often referred to as a Payment Service Provider (PSP). It links your website’s shopping basket or donor form to the card processing network. Lloyds Bank Cardnet has a Payment Gateway platform that supports this requirement.

You must choose a suitable Payment Gateway to meet your business's initial and future needs. Ideally, it should support tokenisation which enables your customers to securely store their card details in a virtual wallet to simplify payment at your checkout.

Fraudsters regularly target ecommerce websites so choose a Gateway with good fraud management.

A Merchant Acquirer will handle the transaction, moving it through the processing network. They will also send you a billing statement.

1. Your customer buys an item on your website with a credit or debit card, or with Google Pay® or Apple Pay®.

2. Their personal details and card information then pass through the payment gateway. Their data is encrypted to protect it before forwarding it to the merchant acquirer.

3. The merchant acquirer sends a request to the customer’s issuing bank for funds to pay for the items or services they wish to purchase.

4. The issuer will either approve or refuse the transaction.

5. If approved, the result is passed back through the payment gateway to advise that:

a. the transaction is accepted

b. your merchant acquirer should credit your account.

The customer will then be told whether or not their payment is accepted.

If the payment is refused, you can simply cancel the purchase with the buyer, or request an alternative card or payment method.

This entire first part of the process takes place within a few seconds. The second part, known as settlement, can take up to a few days.

6. The card issuer sends the funds to your merchant acquirer, which deposits the money into your bank account.

7. The funds are now available for you to use. Your bank may let you access your money before it is even sent to them, but this can vary between banks and accounts.

Your bank may also ringfence some of the money in your account so that you can’t yet spend it. This is known as a reserve. It’s done in case the customer decides to return the goods later. Under the Distance Selling Regulations, customers have the right to change their minds within 14 days.

These can include:

This should inform your decisions about how you build your website, which providers you select and how they integrate.

Some solutions have secure built-in payment software modules that connect to secure payment gateways.

If you haven’t chosen a packaged approach you should select secure, third-party payment software. They’re vital when it comes to protecting your customers' payment details. Options include Google Wallet®† or Paypal†.

There are also secure payment options designed specifically for non-profit organisations. Options for accepting donations include Blackbaud† and DonorPerfect†.