Business loans

A flexible way to expand your business or invest in equipment.

Get an instant decision on up to £5,000 credit as a start-up when you open a Business Account.

Open an account*Eligibility criteria apply.

Take card payments from your customers with our payment solutions.

From the latest insights to guides and customer stories, we provide practical guidance to UK businesses of all shapes and sizes.

Right now, our customers are doing amazing things. Through a combination of hard work, ambition, and some financial support from us, they’ve been able to become more innovative and productive.

Banking online is safe and simple with our mobile app or browser.

Our internet banking service is safe, easy, convenient and helps save your time.

Published February 2025

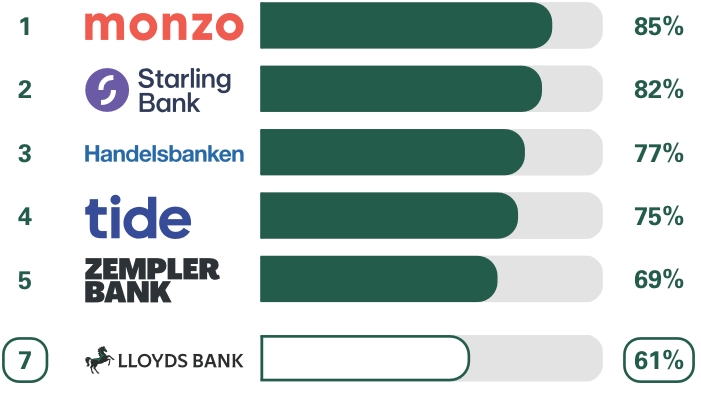

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 16 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here

We work hard to keep your personal and business data secure, which includes regularly reviewing our privacy notice. When there’s an important change we’ll remind you to take a look and share it with anyone within your business who might need to know. This is so you’re aware of how we use your data and what your options are. Please review the latest privacy notice.

All lending is subject to a satisfactory credit assessment and we will need your permission to carry out a credit check on you and your business.

You should not apply for an amount that you cannot comfortably afford to repay now and in the future to avoid the possibility of legal action.

All lending is subject to status. Security may be required.

While all reasonable care has been taken to ensure that the information provided is correct, no liability is accepted by Lloyds Bank for any loss or damage caused to any person relying on any statement or omission. This is for information only and should not be relied upon as offering advice for any set of circumstances. Specific advice should always be sought in each instance.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).