Business cards

Work out how much cashback you could earn.

Current accounts for community and non-profit organisations such as clubs, charities, associations and societies.

We have options to suit different types of community organisations. The account that’s best suited to you will depend on how you’re set up. You can find out more below:

This account is for non-profit organisations, clubs and unregistered societies who expect to pay less than £250,000 into the account every 12 months

This account is for registered charities and organisations with excepted charity status who expect to pay less than £50,000 into the account every 12 months.

Find the account that’s best suited to your organisation and apply in minutes

These accounts are not for sole traders, businesses or clubs and societies that operate for profit. They will require a business account

Accounts for schools or credit unions can be found here

If you are a parish council, please call us on 0800 036 0056 to apply or switch to a new account.

|

Account features |

Account for clubs & societies |

Account for charities |

|---|---|---|

|

Account features Available to |

Account for clubs & societies Non-profit making clubs, societies, organisations with less than £250,000 paid into the account every 12 months |

Account for charities Registered Charities, including organisations with excepted charity status with less than £50,000 paid into the account every 12 months |

|

Account features Monthly account fee |

Account for clubs & societies £4.25 |

Account for charities No account fee |

|

Account features Transaction & service fees |

Account for clubs & societies You may have to pay for some specific services. See our Product Specific Conditions (PDF, 650KB) and Account Charges & Processing Times (PDF, 666KB) |

Account for charities You may have to pay for some specific services. See our Product Specific Conditions (PDF, 144KB) and Account Charges & Processing Times (PDF, 666KB) |

No credit interest is payable on these accounts. See the full account rates and charges and product terms and conditions.

Estimate with our calculator how much your Community Account could cost per month.

Whether you’re a charity, community group or another kind of not-for-profit, here you’ll find guidance and support to help manage your banking more effectively.

If you don’t meet the criteria for a community account, a different business account may be better suited:

Who is this account for?

Not suitable for?

Who is this account for?

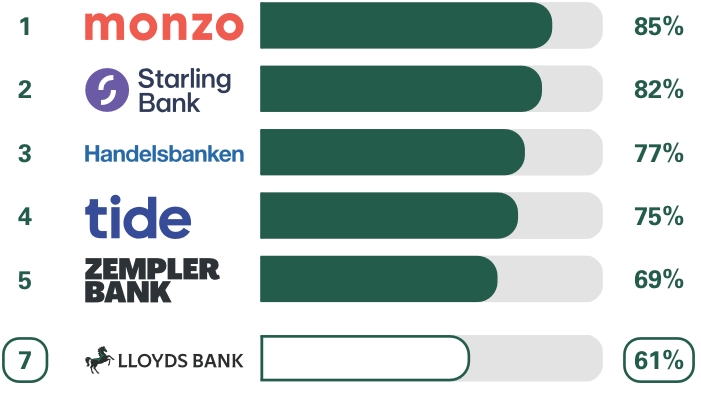

Published February 2025

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 16 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here