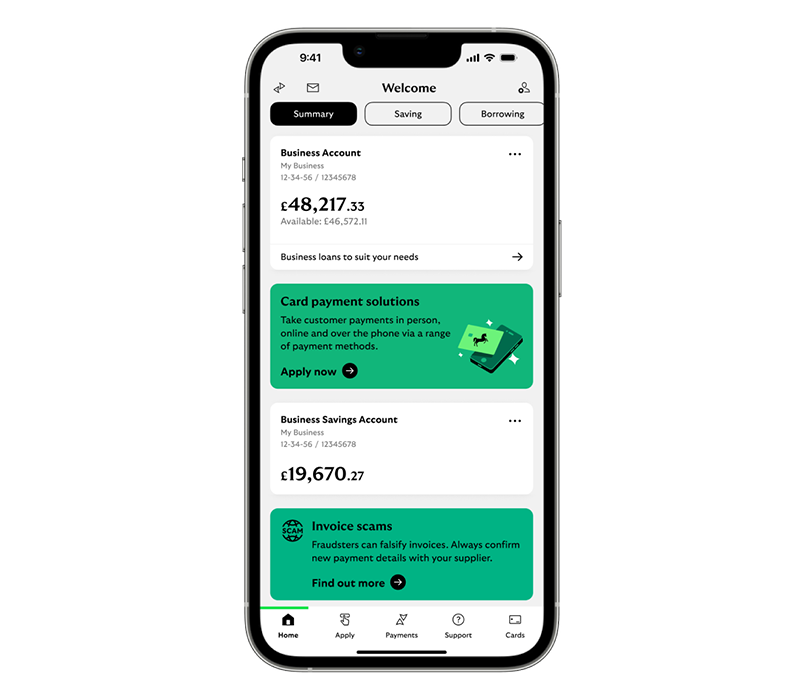

Download our app

You can pay in cheques, transfer money, and do much more, all from your mobile.

Save time and make your work life easier with our safe and simple-to-use internet banking service.

Log onYou’ll find the full list of features, access levels and account information in our detailed guide: Online for Business functionality (PDF, 169KB)

You can register yourself for online banking in just a few minutes:

Use our handy app to keep an eye on your accounts wherever you are.

Do your bit for the environment by getting everything online.

If you’ve got a new address, update it online to let us know.

Let us know about other changes to your business.

Support for new and existing users with logging on.