Download our app

You can pay in cheques, transfer money, and do much more, all from your mobile.

Switching your account to us means you’ll get access to all the tools you need to make managing your business easier and to help your business grow.

Start switching Apply for our payment solutionsTo move accounts, first apply online for a Business Account. Once your account is open, you can switch using the Current Account Switch Service. To apply, you must:

If your business has an annual turnover between £3 million and £25 million, find out how to apply. The Current Account Switch Service is not available for accounts for community organisations.

And get ready to join the 1 million businesses who already bank with us.

Apply today for a Business Account or Community Account. If you qualify for the Current Account Switch Service, you can use this to switch later.

There’s so much more to our bank account than just digital banking. As well as no account fee for 12 months, you’ll also be able to:

Manage your cash flow and help your business grow. Borrow up to £25,000 across a Business Credit Card or Business Overdraft. Once we’ve set up your Business Account, you can apply online. You’ll get an instant decision whether you’re successful or not.*

As your business grows, your finance needs will change and evolve too. Wherever you decide to take your business next, we can help with a wide range of finance solutions to suit your needs.

Offer a flexible way to invest in new equipment and expand your business.

We have a range of products and tools to support you in trading internationally.

Wherever you are in your journey to Net Zero, we can help you grow sustainably.

Find out more about our Business Account fees and charges.

|

Payment type |

Charges |

|---|---|

|

Payment type Introductory offer |

Charges No monthly account fee for 12 months |

|

Payment type Monthly account fee |

Charges £8.50 after 12 months |

|

Payment type Electronic payments in1 |

Charges Free |

|

Payment type Electronic payments out1 |

Charges First 100 a month are free / £0.20 each after that |

|

Payment type Cash payments (in or out) |

Charges £0.85 for every £100 at an Immediate Deposit Machine / £1.50 for every £100 over the counter |

|

Payment type Cheques (in or out, any amount) |

Charges £0.85 at an Immediate Deposit Machine / £1 over the counter |

|

Payment type Credit paid in at branch or ATM |

Charges £0.85 |

|

Payment type Credit paid in at an Immediate Deposit Machine, Automated Deposit Machine, through the app |

Charges Free |

|

Payment type BACS |

Charges File submission: £5.50 BACS Item: £0.15 (a set up fee may apply) |

|

Payment type CHAPS |

Charges £30 |

|

Payment type Sending and receiving money abroad |

Charges |

|

Payment type Balances below £0 (going overdrawn) |

Charges |

|

Payment type Other account services |

Charges |

See the full account rates and charges (PDF, 666KB) and product terms and conditions.

Estimate with our calculator how much your business account could cost per month after the first year.

Your business bank account will switch within seven working days from when your new account is opened under the Current Account Switch Service guarantee.

No, you won’t need to close your old bank account yourself. Your old bank will close your account as part of the Current Account Switch Service process. All you need to do is fill in the instruction form to authorise the closure.

Making the switch to a business bank account with Lloyds Bank, or any other bank using the Current Account Switch Service, is straightforward. It’s an easy process designed to make changing banks and transferring important information stress-free. Sit back and wait until your switch date and we’ll take care of the rest.

Eligible deposits with Lloyds Bank plc are protected up to a total of £85,000. Due to eligibility criteria, not all business customers will be covered.

*Apply online once your new Business Account is set up and you’ll get an instant decision. Eligibility for lending will be assessed as part of a separate application, and there is no guarantee of lending being granted. All lending is subject to status.

1Electronic payments include:

Published February 2025

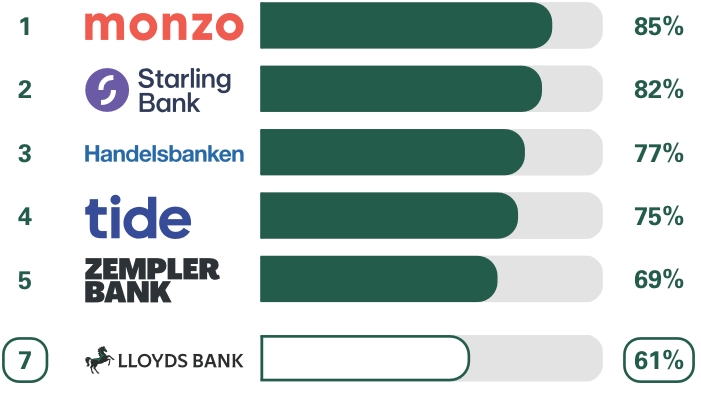

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 16 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here